Sri Lanka’s leading integrated financial services provider, HNB Finance PLC, has been ranked among Sri Lanka’s 100 most valuable consumer brands by Brand Finance for the second consecutive year, reflecting the strong trust placed in the company and its stability by the public.

With an estimated brand value Rs. 1,264 million in 2022 and a brand rating of ‘A-’, HNB Finance has been ranked among Sri Lanka’s 57 most valuable consumer brands in both 2022 and 2021 by Brand Finance. This places the company ahead of many of its peers in the non-banking financial institution (NBFI) sector, reflecting HNB Finance’s impeccable track record and excellence as a financial partner for over two decades. The company’s reputation also benefits from the added strength stemming from the backing of its parent, HNB PLC – one of Sri Lanka’s largest private banks.

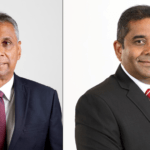

“This ranking represents a strong independent endorsement of HNB Finance’s customer offering and customer-centric approach, in pursuit of continuous improvement in customer experience and service,” HNB Finance PLC Managing Director/CEO, Chaminda Prabhath said. “Being featured among Sri Lanka’s top 57 consumer brands for two consecutive years also reflects the consistency of HNB Finance, in delivering on and exceeding the expectations of our valued customers.”

In parallel with receiving this recognition from Brand Finance, HNB Finance recently completed its amalgamation with Prime Finance, paving the way to optimise the synergies stemming from the merger between the two companies.

About HNB Finance

HNB Finance PLC was established in the year 2000 and is licensed as a registered Finance Company by the Monetary Board of the Central Bank of Sri Lanka. The company holds a National Long-term Rating at ‘A(lka)’; as affirmed by Fitch Ratings. Maintaining an extensive island-wide presence across 77 branches, HNB Finance offers a range of exceptional financial services which include Small and Medium Enterprise (SME) loans as well as leasing, gold loans, housing loans, personal loans, savings and fixed deposits facilities.